Daily Digest 9/3

Insight on the biggest news and charts that provide context for whats going on in the market today.

$4.4 Billion EOS Token Raise Fueled by Wash Trading, Says New Research

Popular cryptocurrency EOS was initially launched via an ICO in 2018 where it raised $4.4 billion.

Initial coin offerings have had issues in the past which led many people losing money to projects that did not really exist.

EOS was one of the largest ICO of all time but forensic analyst John Griffin has found evidence of “suspicious trades” during the ICO.

Griffin found that 21 different addresses had bought large sums of EOS and then sold them immediately to raise price and create a demand that isn’t really there. This is an example of wash trading.

The founders of EOS has said that Griffin “has found no evidence” and the SEC has already fined Block.one for not registering the EOS ICO.

New Poll Finds El Salvador Still Doesn’t Want Bitcoin

As El Salvador has just made it official that BTC is legal tender in the country some of the citizens are not in favor of it.

A survey done by Central American University revealed that of the 1,281 people surveyed that 68% of them disagreed with BTC becoming legal tender.

Another survey conducted that more than 75% of the people surveyed thought that BTC adoption is not very wise.

Some have also taken to protests but on Sept. 7th the move will still be putting into effect.

What Apple Settling App Store Lawsuit Means for Crypto NFTs

When Apple settled the class action lawsuit against them last week they agreed to loosen some of the restrictions that they have put on smaller developers by not allowing their consumers to pay for services outside the app store.

Pending approval, the agreement stipulates that developers can share payment options with customers outside of Apple’s iOS app.

This also helps the NFT gaming market would now be able to release their apps on Apples app store without violating the terms of agreement.

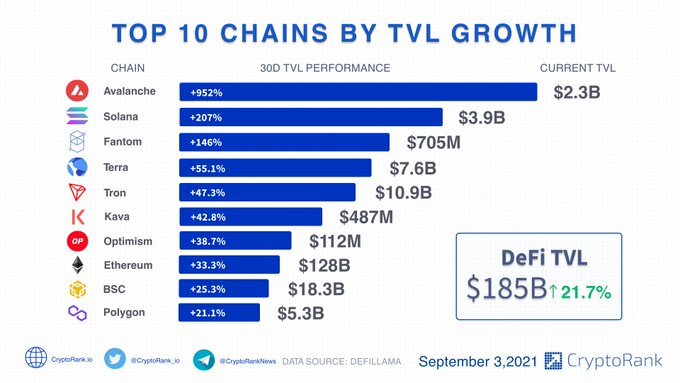

Ethereum comes in at number 8 on this list and it could continue to fall in the coming months. From retail investors to developers everyone is looking for alternatives to the high gas fees on ETH. As these other ecosystems like Solana and Avalanche continue to grow and make Dapps that can compete with Aave and Uniswap then they could definitely continue to eat away at ETHs market share.