What BTC Price Slump? Bitcoin Outperforms Stocks and Gold for 3rd Year in a Row

But concerns remain that the cryptocurrency could fall harder than its traditional rivals in 2022 on the U.S. Federal Reserve’s increasingly hawkish tones. Read the full article by Yahsu Gola “Neither this post nor any other on cryptofal.com should be taken as financial advice. It is not.”

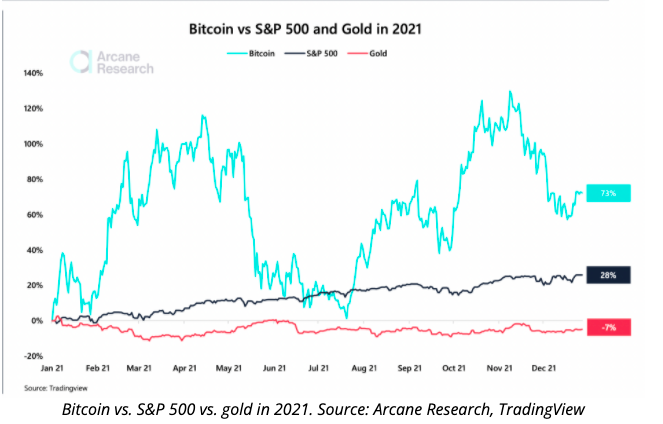

It has been a rough couple of weeks for Bitcoin. It’s even down 30% from its all-time high of $69,000 in early November. A report done by Arcane Research showed a more positive perspective from looking at what it’s done still over the year. Bitcoin is still up 73% and that makes it the third straight year that it has outperformed the S&P 500, up 28%, and gold which is now down 7% for the year.

Inflation is again being highlighted as a reason for the high interest in Bitcoin recently. The Consumer Price Index (CPI) just had its largest one-year increase in the 40 years. Institutions realized this too as they have been buying Bitcoin to offer ETFs to their clients. The Arcane report showed inflows of 140,000 BTC (~$6.56 billion) in Bitcoin ETFs. At the same time, gold saw $8.8 billion in outflows for the year.

It is also important to point out the high volatility of BTC which does not make it an ideal inflation hedge according to many market analysts.

“It seems strange to think that a person who is worried about holding dollars because they lost 7% of their value over the last year would be comfortable holding Bitcoin which could (and often does) lose that much value in a single day.” said Leonard Kostovetsky, a finance professor at Boston College.

Even Trend forecaster G. Celente, is calling for a financial disaster in 2022 because of the excessive money printing and stimulus checks.

“When you look at inflation, the only reason the markets have gone up is the cheap money. All the cheap money artificially threw this thing up. All the cheap money is coming in from governments to prop it up artificially. So the whole thing has been artificial. My belief is when the Fed rate hits 1.5%, this thing goes down hard, big, and the biggest crash in world history.”

It will be interesting to see what happens going forward but the sentiment has not been great recently.