8/19/22 FAL Weekly Digest

The FAL Weekly Digest is a source for this week’s biggest cryptocurrency-related news and updates. This newsletter features excerpts and links to this past week’s biggest news articles written by members of FAL Consulting’s writing team or gathered from other listed sources.

Regulation

Tornado Cash

Launched in 2019, Tornado Cash is a privacy tool that works to obfuscate the origin of Ethereum transactions by pooling together large numbers of transactions and mixing them to prevent them from being tracked on the public blockchain. The privacy offered by Tornado Cash, however, has long drawn close attention from authorities, many of which are concerned that the tool is being used for money laundering and other illicit activities.

The Netherlands Crime Agency (FIOD) announced they had arrested a “suspected developer” of Tornado Cash, the Ethereum-centric mixing service sanctioned by the U.S. Treasury earlier this week. “On Wednesday 10 August, the FIOD arrested a 29-year-old man in Amsterdam. He is suspected of involvement in concealing criminal financial flows and facilitating money laundering through the mixing of cryptocurrencies through the decentralized Ethereum mixing service Tornado Cash,” the agency said in a statement.

Read more on Info Hub (Premium)

The Fed Released Guidelines for Crypto Banks

The Federal Reserve has revealed plans to begin a program in which “institutions offering new types of financial products or with novel charters” could be granted “master accounts,” a pivotal financial status that enables the company to access the FED. All banks that work with the Fed retain a master account.

The 49-page ‘Final Guidance’ makes mention of cryptocurrency only once, in connection with the novel institutions that could potentially seek master accounts within these new guidelines. However, the subtext of this document is unarguably tied to the crypto industry.

Recently, the crypto bank founded by former Morgan Stanley managing director Caitlin Long, Custodia, sued the Federal Reserve in June, citing the 19-month delay in the bank's master account application process. The Fed claims the application process for master accounts typically only takes five to seven business days.

The delay is presumably due to the Fed's uncertainty about giving traditional banking powers to crypto institutions such as Kraken and Custodia; the former has also been in the master account limbo process. Speaking on the delay in January, Federal Reserve Chairman Jerome Powell claimed the process was slowed due to such a decision's “hugely precedential” nature.

The Fed is hopeful that this recent release will help streamline the application process for “novel” establishments like Kraken and Custodia.

Read more on Info Hub (Premium)

FOMC July Meeting Minues

The minutes revealed little outside of what many expected, which was that the Fed will continue its hawkish stance for the remainder of the year. This month's restraint on hiking the interest rate to 100 basis points demonstrates how the Fed is looking to play a numbers game to maintain the delicate balance of the economy. Raising rates 75 basis points signaled that while the FOMC is aware higher rate hikes may squeeze the economy too tightly, taking too much of a dovish approach may damage the progress made so far. As a result, the subsequent rate hikes can be expected to be in the range of 50-75 basis points until the end of the year. If the Fed is looking to ease up the pressure, it's unlikely to occur before 2023.

Metamask to Partner With Investigative Firm to Combat Fraud

If you've ever had your credit card stolen, and been charged for transactions you never approved of then chances are Visa or the like will reverse them and give you back your funds. But the same assurance can not be given to the crypto community.

"If you lose your crypto, it’s a very humbling and lonely experience. And the amount of people who get scammed twice is huge," says Aidan Larkin, CEO of investigation firm Asset Reality, who adds that maliciously, the victims are usually further hacked when attempting to get their original tokens back.

This is why Asset Reality and popular crypto wallet service, MetaMask, are teaming up for a new service that hopes to make the process for those seeking to regain their crypto a lot easier.

MetaMask announced an innovative solution to put hacking victims in touch with Asset Reality. The corporation will then work with the victims of these hacks to get in contact with potential lawyers, law enforcement, or even forensic services.

Read more on Info Hub (Premium)

South Korea Delays Crypto Tax & Starts to Set Clear Guidelines

The delay came just a few months after the newly elected president named Yoon Suk-yeol promised to work first on regulations. The government of South Korea reportedly postponed the 20% tax on crypto gains by two years. This controversial tax on cryptocurrency gains was scheduled to go into effect on 1st January next year but was postponed to 2025.

South Korea’s Financial Services Commission (FSC) reported 16 foreign crypto exchanges to investigative agencies for violating the Specific Financial Information Act, news1 reported on August 18. According to the report, the law prevents unregistered crypto exchanges from operating without a license, but the 16 firms have been providing crypto services for Koreans and hosting events targeting Koreans.

Ethereum

Upcoming Merge Information

Leading into the Ethereum update which is currently estimated to be completed by September 19th has people more excited than ever for what Ethereum future and price predictions will hold. What that could also lead to is false expectations and rumors floating around on what is going to be one of the biggest updates of the year.

The Ethereum team has addressed some of these misconceptions in a new blog post, as it will go live in a few weeks. The present proof-of-work mechanism will come to an end when the Ethereum Mainnet merges with the Beacon Chain proof-of-stake system. Since this mechanism uses so little energy, according to the blog article, Ethereum’s energy consumption will be cut by 99.5%. But the Ethereum Foundation clarified on Wednesday that the network’s next proof-of-stake temporary upgrade, known as the “Merge,” will not lower gas costs.

Read more on Info Hub (Premium)

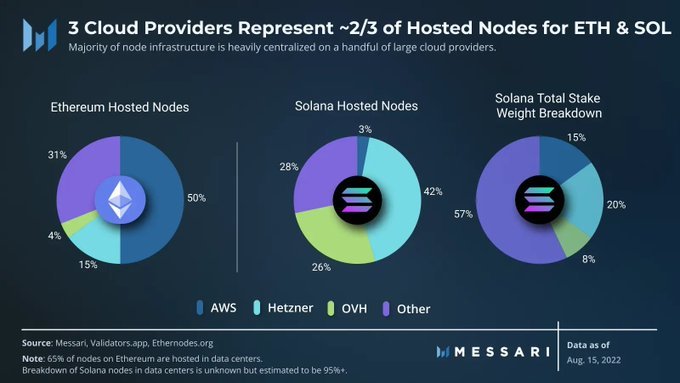

Half of Ethereum’s Nodes Are Being Run On AWS

Recent reports and data are showing that an alarmingly large portion of Ethereum’s active nodes are being run on centralized cloud service providers. Ethernodes, an ETH network and node explorer, shows that 65% of nodes (2992 nodes) are being run on hosting services. There are currently a total of 4,578 active nodes. Of the web service providers, Amazon hosts 52% (1442 nodes) and Hetzner Online hosts 16.9% (467 nodes).

Cardano

Cardano Node Version 1.35.3 Released

Cardano released version 1.35.3 of cardano-node on 8/11/22. This node provides full Vasil era capabilities and according to founder Charles Hoskinson this is likely the version that will be used for the hard fork. In their list of “Known Issues” there are 16 remaining/open bugs listed. All of these bugs were noticed from the testnet fork or prior, with the oldest bug reported on May 24. It is also stated that none of these known issues will block the mainnet hard fork.

Cardano released version 1.35 of their node on June 25, but was rolled back shortly after back to the percious version 1.34.1 (originally pushed on March 7, 2022). Twenty nine bugs have been resolved since developers rolled back version 1.35.

In addition to the performance upgrades, the Vasil hard fork should also lower transaction fees. The average transaction fees on the blockchain are already well under $1, usually around 0.16 $ADA or a few cents. Smart contract functionalities will be improved but puts more focus on scaling and network/ledger optimization. The Alonzo era/update introduced smart contract support for the platform in September 2021.

Mining

Miners See Slight Ease in Sell Pressure

After the market crash following the Terra Luna collapse, many miners were forced to sell much of their reserves to prevent liquidation. According to Arcane Research, July saw public miners sell about half of what was sold in June. Many public mining companies and firms built up reserves from over a year of successful mining. Most of these companies also had multiple expansion plans lined up for the upcoming years.

July marks the third month in a row that Bitcoin miners sold more BTC than they produced. This means that at least a portion of what was sold was taken from reserves.

More Q2 Losses Reported

Riot Blockchain Reported $366 Million Loss

Riot reported $366 million in net loss for Q2. These losses were mainly due to impairment charges. The firm mined 1,395 BTC, which is only down 0.7% from the previous quarter. Revenue fell by 8.7%

Riot Blockchain is a Bitcoin mining firm with multiple operations in Texas. Among these operations, Riot’s Whinstone facility in Rockdale, Texas is expected to be North America’s largest Bitcoin mining facility once fully expanded. The company also offers hosting services in their facilities for miners who would like to store and operate their mining machines through Riot. This facility hosts mining operations for two institutional clients.

Their other facility, Corsicana, is expected to be even larger with a 1 gigawatt capability once fully expanded. Riot’s website explains that the first phase of this expansion will cost approximately $333 million, which was scheduled to be invested over 2022 through the first quarter of 2024.

Bitfarms

Bitfarms also reported a $142 million Q2 loss on August 15 although they reported a 5% increase in revenue. Last quarter, Bitfarms was able to net an income of $5 million. Bitfarms is also currently expanding two 50-megawatt warehouses in Argentina.

Market

Market Cap: $1.029 T; down from $1.146 T last week

24h Volume: $87.083 B; up from $67.2 B last week

BTC Dominance: 39.7%; down from 40% last week

ETH Dominance: 20.1%; down from 20.2% last week

None of our posts or newsletters are meant to be taken as financial advice.